Why Vendor Onboarding Is Failing

What 500 Enterprise Assessments Tell Us About the Bottleneck

Vendor onboarding should be simple.

Your business wants to work with a vendor. You evaluate their security posture. You approve them. Done.

However, in reality, vendor onboarding has become one of the slowest and most frustrating processes within the enterprise. Using a labyrinth of workflows designed decades ago:

- Email-based questionnaires

- Manual evidence collection

- Sequential reviews between siloed teams

- Human interpretation of SOC reports and audit documents

- Static assessments that are point-in-time snapshots

Originally, this approach may have worked when enterprises had 200 vendors, predictable technology stacks, and slower procurement cycles.

Today, with thousands of vendors, continuous integration, and rising regulatory oversight, the traditional approach simply cannot scale.

So the question becomes:

If we know where delays occur, what would a model look like that directly eliminates them?

The modern enterprise can’t afford a 90-day lag between wanting to work with a vendor and actually doing it.

Every day of delay slows down business in highly competitive environments.

Corentin Le Reun, CEO

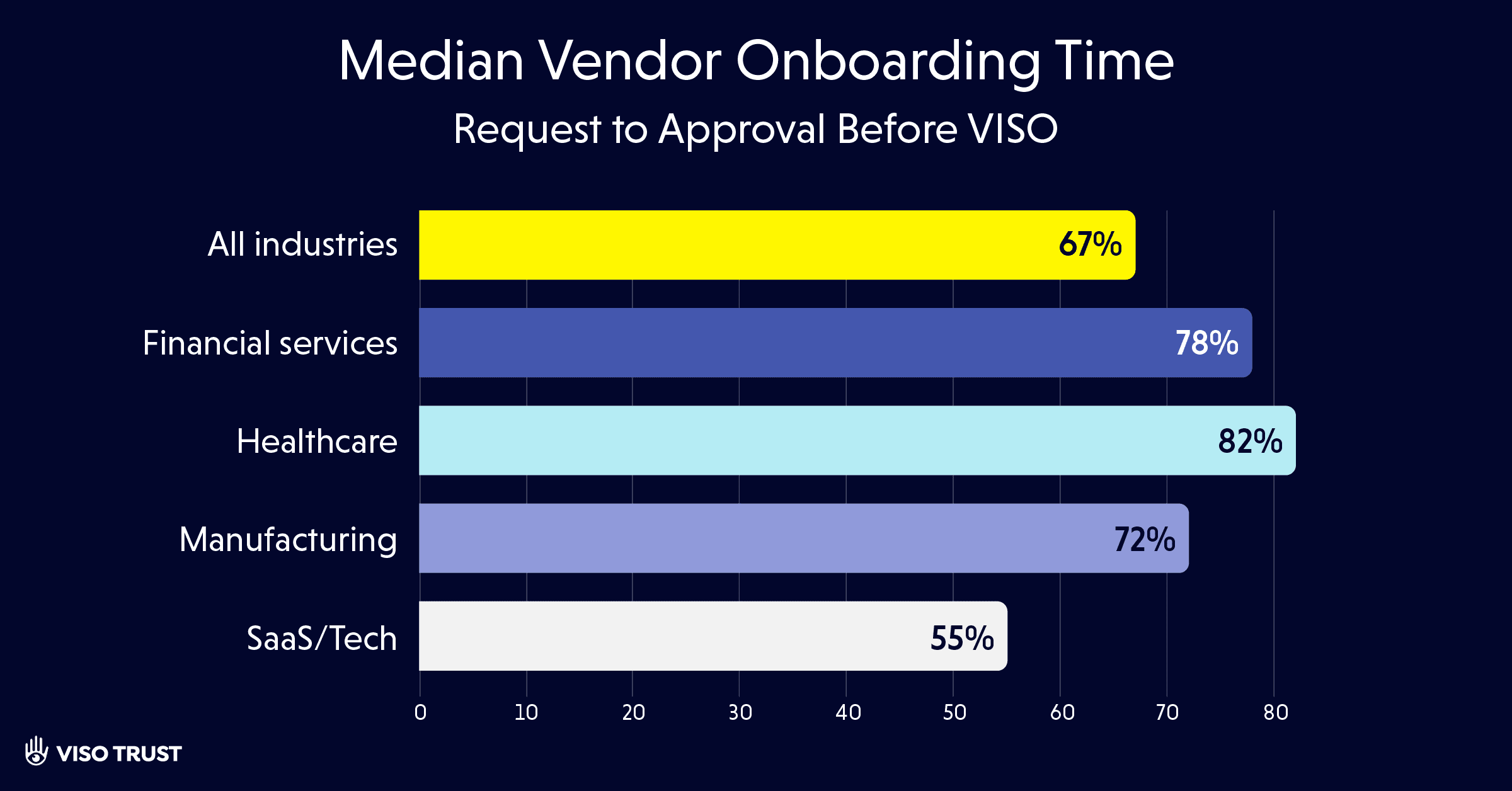

How Long Vendor Onboarding Really Takes

Most organizations believe vendor onboarding takes 4–6 weeks.

Yet, the data proves otherwise.

Median Vendor Onboarding Time

(Across 500 enterprise assessments)

These align closely with external benchmarks:

- …the process can take up to six months at many large companies (Institute For Supply Management)

- 52% of companies say it takes 31-60 days to perform control assessments of third parties. (EY)

- 38% say it takes 61-90 days, while just 8% can perform control assessments within 7-30 days. (EY)

In other words, enterprises consistently underestimate how long onboarding really takes – often by a factor of two.

The Scale Problem: Too Many Vendors, Too Little Time

Even if onboarding one vendor took 60 days, that might be manageable.

But large enterprises don’t onboard one vendor at a time – they onboard hundreds.

Across the VISO TRUST platform, we see the same pattern repeated:

- Bulk cycles as large as 450 assessments triggered at once

- Many teams are initiating 10 – 20 new reviews every week

Consequently, the math becomes impossible to ignore:

Manual onboarding processes don’t just slow teams down — they collapse under the weight of modern vendor ecosystems.

At the same time, the stakes are only rising.

The entire third-party risk landscape is shifting, with pressure accelerating from every direction:

- SEC: mandatory disclosure of material third-party cyber incidents

- IBM: 1 in 6 of breaches involving AI-driven attacks

- Security Scorecard: Between 60 and 90 times larger – that’s the size of a typical organization’s fourth-party ecosystem relative to its direct third-party vendor set

- NIST: now requires continuous monitoring and supply-chain oversight

- CISA: unmitigated vulnerabilities in the software supply chain – including risks introduced by third-party software — pose a “significant risk” to enterprises and critical infrastructure

As a result, this convergence of scale, complexity, and regulation has created a structural gap: traditional TPRM workflows – questionnaires, spreadsheets, manual reviews – simply cannot keep pace with the modern enterprise.

Tomorrow’s third-party risk management will hinge on embedding rich business context into the evaluation of every supplier.

Manual, legacy TPRM methods are no longer viable – they collapse under the demands of scale.

Russ Sherman, CTO and Co-Founder

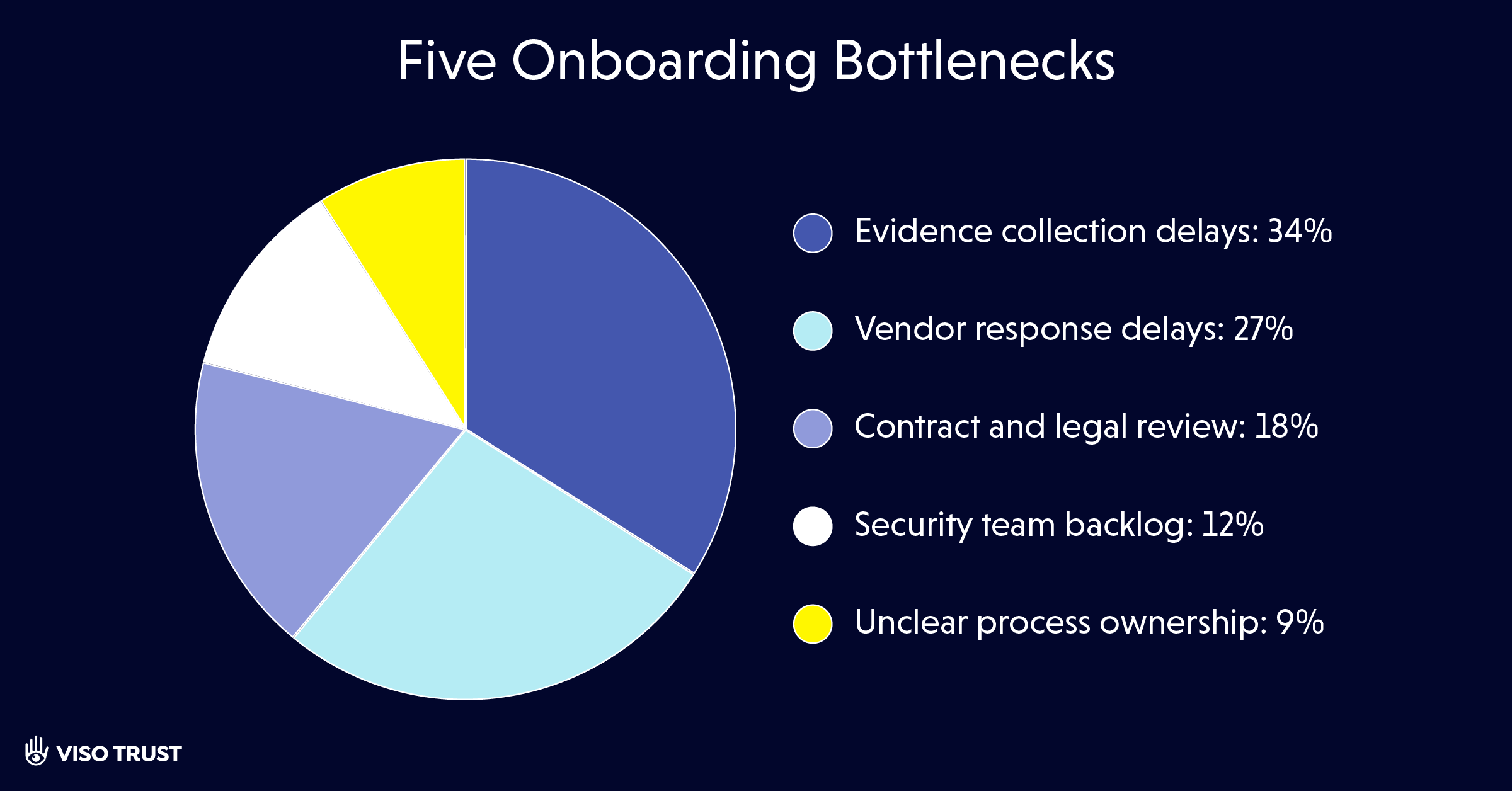

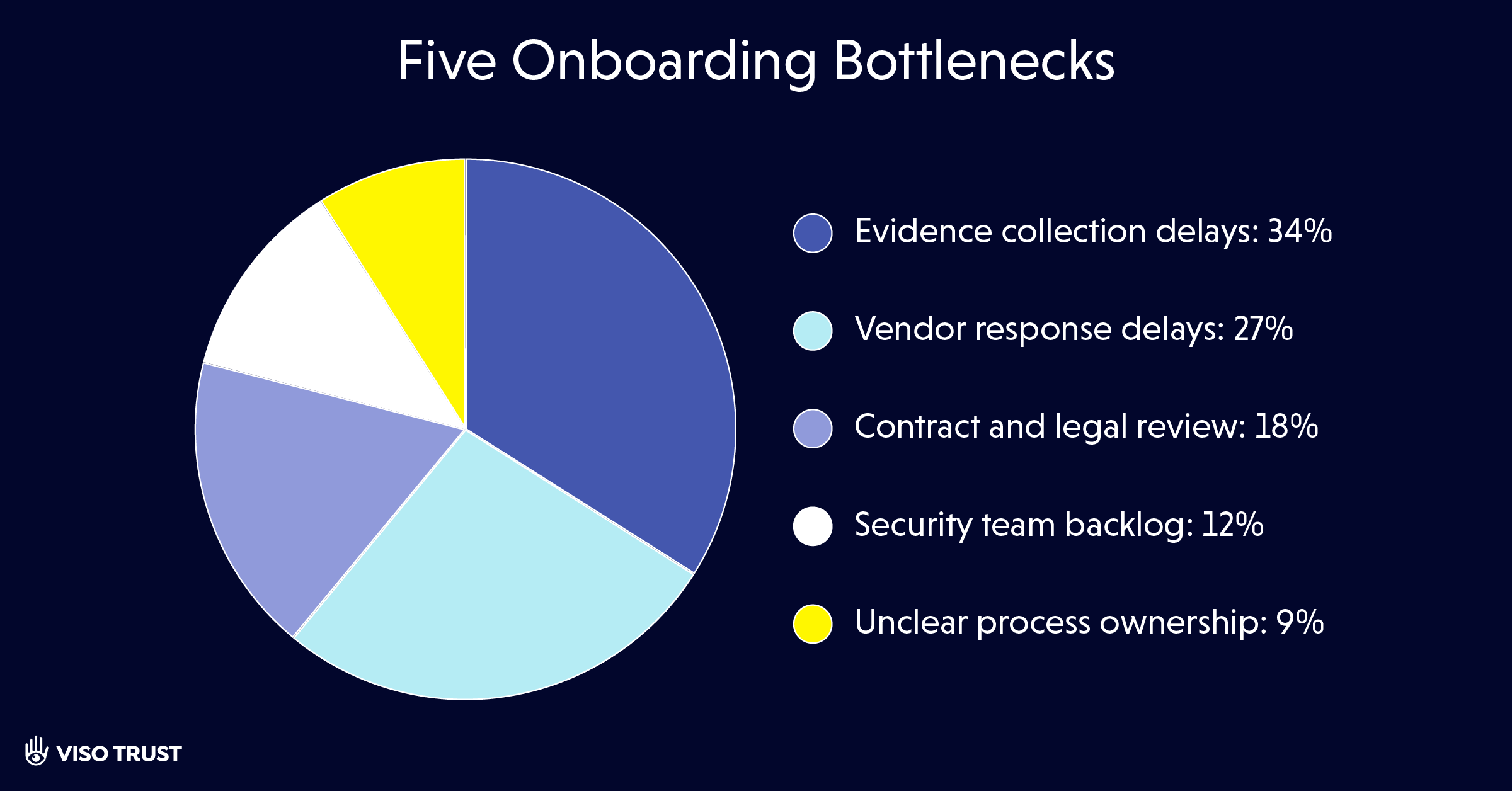

The Top 5 Bottlenecks

Our analysis revealed a clear pattern: five bottlenecks consistently cause the majority of onboarding delays. Let’s unpack these one by one and look at how VISO TRUST was purpose-built to address them.

Evidence Collection Delays

What the data shows:

34% of the total onboarding lifecycle is spent waiting for vendors to collect, upload, or clarify evidence.

How VISO addresses it:

- Ingests existing audit reports (SOC 2, ISO, CAIQ, SIG, etc.)

- Uses AI to extract controls and validate evidence

- Eliminates questionnaires for the vast majority of vendors

- Provides vendors with structured, minimal evidence requests

- Automates reminders and escalations

As a result:

Assessment cycles shrink from weeks to 1 to 5 days, because the biggest source of delay, manual evidence collection, is removed from the critical path.

Vendor Response Delays

What the data shows:

Vendor response latency is a major cause of cycle time inflation. Internal logs show vendors often stall due to unclear instructions.

How VISO addresses it:

- Replaces unstructured emails with standardized, precise requests

- Uses AI to interpret vendor documentation even when formats vary

- Auto-generates follow-up requests when needed

- Reduces vendor workload by up to 90% by leveraging preexisting evidence

Therefore:

Vendor responsiveness improves dramatically, often within 24 to 48 hours, aligning onboarding speed with business expectations.

Contract & Legal Review

What the data shows:

Legal often waits for security, creating sequential bottlenecks.

Industry research from World Commerce & Contracting shows that poor contract management can erode nearly 9% of annual contract value, underscoring how slow, fragmented negotiation and legal review act as a major bottleneck in third-party risk and vendor management processes.

How VISO addresses it:

- Centralized vendor profiles give legal immediate context

- Enables parallel workflows

- Clarifies data access, regulatory impact, and materiality up front

- Reduces redlining by linking to validated evidence and controls

Consequently:

Legal review accelerates because teams start with context instead of questions.

Security Team Backlog

What the data shows:

41% of organizations rely on spreadsheets for TPRM, while only 29% can assess risk across the full vendor lifecycle (GRC Report).

How VISO addresses it:

- AI performs the initial assessment in hours

- Assessment includes mapping to common frameworks

- High-risk findings are escalated to human auditors

- Low-risk vendors are auto-cleared through policy-based rules

As a result:

Manual review drops from weeks, to 1–3 days, freeing teams to focus on exceptions.

Unclear Process Ownership

What the data shows:

Shared Assessments (2025) reports that EY’s 2025 Global TPRM Survey that 83% of TPRM programs struggle with internal coordination and communication, and 82% experience delays caused by unclear or fragmented ownership across teams. These breakdowns create bottlenecks that slow vendor onboarding and risk reviews.

How VISO addresses it:

- Automates assignment based on data sensitivity, regulatory exposure, third-party relationships, and integration patterns

- Alerts the correct stakeholders in parallel

- Provides shared visibility across teams

Therefore:

The vendor no longer gets stuck between departments – the system handles the routing.

How VISO TRUST Solves It

Vendor onboarding shouldn’t be a manual checklist – it should be an intelligent, automated workflow. Accordingly, VISO TRUST redefines the process end-to-end with AI, evidence automation, and built-in compliance.

AI-Driven Intake

Streamlined intake forms automatically build vendor profiles, enrich them with OSINT, and trigger Instant Assessments based on inherent risk — no manual triage required.

Artifact-First Evaluation

Instead of relying on questionnaires, VISO TRUST analyzes real security evidence such as SOC 2s, pen-tests, certifications, and architecture diagrams. Controls are extracted, validated, and mapped automatically.

Streamlined intake forms automatically build vendor profiles, enrich them with OSINT, and trigger Instant Assessments based on inherent risk — no manual triage required.

Automated Artifact Requests

AI Agents detect missing documentation, request it through a self-service vendor portal, and verify submissions. Evidence is then mapped to NIST, ISO, HIPAA, PCI, CIS, and other core frameworks.

Audit-Ready Reporting

Every assessment automatically generates a Smart Summary – a framework-aligned, traceable report designed for auditors, regulators, security teams, and executive leaders.

The Takeaway: Speed, Context, Confidence

The conclusion from 500 assessments – supported by global research – is clear:

Vendor risk is a business bottleneck, but it’s solvable.

VISO delivers:

- Speed: From 2–3 months to days

- Cost: Lower outsourcing and manual overhead

- Clarity: Real-time vendor and fourth-party visibility

- Governance: Defensible board and regulator reporting

- Scale: Manage hundreds of vendors without adding staff

Ultimately, the future of TPRM is intelligent, connected, and context-driven.